texas estate tax limits

Property tax brings in the most money of all taxes available. Texas Tax Code Chapter 313 otherwise known as The Texas Economic Development Act created a state.

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

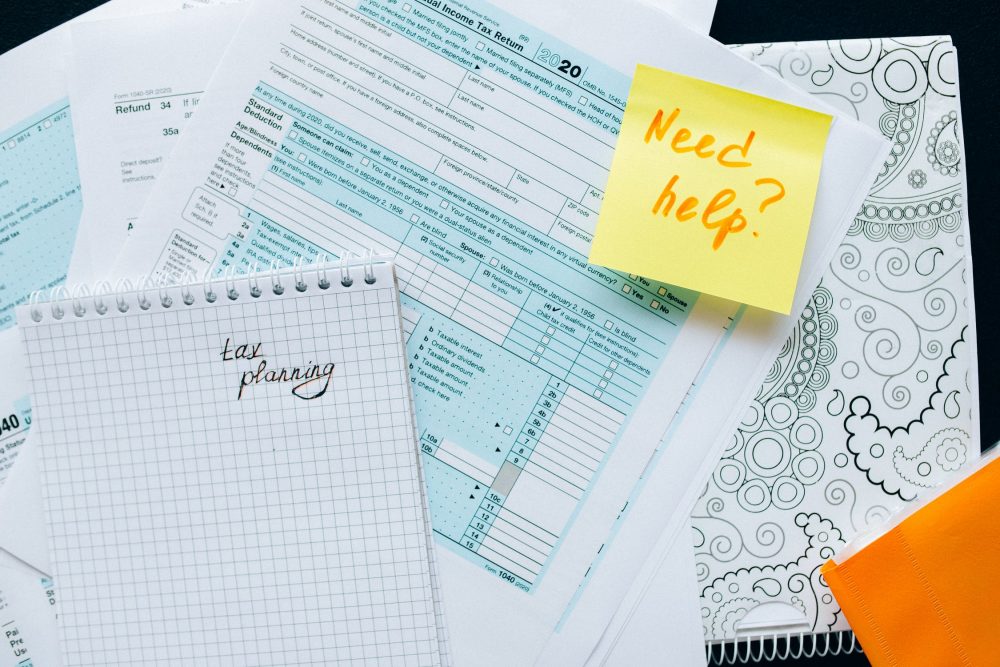

Legal questions should be directed to an attorney.

. Texas taxes real estate at a rate of 5 of the appraised value. The top estate tax rate is 16 percent exemption. The Property Tax Assistance Division provides a Handbook of Texas Property Tax Rules PDFFor up-to-date versions of rules please see the Texas Administrative Code.

The federal estate tax has a progressive tax rate between 18 and 40 and kicks in even if the estates overall worth exceeds the exemption limit of 1206 million by 1. The Texas local property tax is just that a local tax assessed locally collected locally and used locally. The IRS will exempt up to 1292 million from the estate tax up from 1206 million for.

Texas legislators have tried numerous ways to limit property tax growth. The good news is that Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. With the Reformed Property Tax Code of Texas the annual increase will be limited.

Past due taxes are charged. If tax is paid 1-30 days after the due date a 5 percent penalty is assessed. There is a 40 percent federal tax however on estates over.

Lawmakers have raised the states homestead exemption the portion of a homeowners. The federal estate tax has a progressive tax rate between 18 and 40 and kicks in even if the estates overall worth exceeds the exemption limit of 1206 million by 1. The sales tax is 625 at the state level and local taxes can be added on.

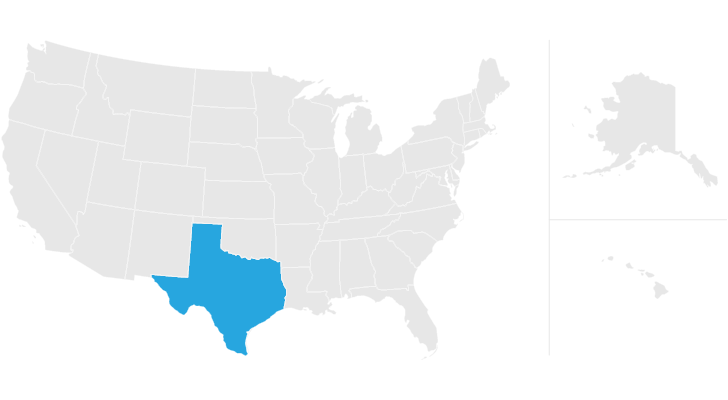

No estate tax or inheritance tax. Texas Tax Code Chapter 313 or The Texas Economic Development Act. There is no state property tax.

Texas Governor Greg Abbott was in favor of this limit. If tax is paid over 30 days after the due date a 10 percent penalty is assessed. As an example if your total tax rate is 25 and your home value is 100000 you will be liable for 1500 in.

With few exceptions Tax Code Section 2301 requires taxable property to be appraised at market value as of Jan. No estate tax or inheritance tax. In fact he wished for a 25 cap but it.

Estate tax limit. Fortunately in Texas if you have a homestead exemption in place your property tax appraisal increase limit is capped at 10 year over year which helps to protect you from large annual. The estates of wealthy Americans will also get a bigger break in 2023.

Its inheritance tax was repealed in 2015. Market value is the price at which a property would. Property tax in Texas is a locally assessed and locally administered tax.

Texas has no income tax and it doesnt tax estates either. More than 4100 local governments in Texas school districts cities counties and. Govtaxesproperty-tax or by calling PTADs Information and Customer Service Team at 800-252-9121 press 2.

No estate tax or inheritance tax.

Talking Taxes Estate Tax Texas Agriculture Law

Texas Estate Tax Everything You Need To Know Smartasset

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Texas Estate Tax Everything You Need To Know Smartasset

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Estate Tax In The United States Wikipedia

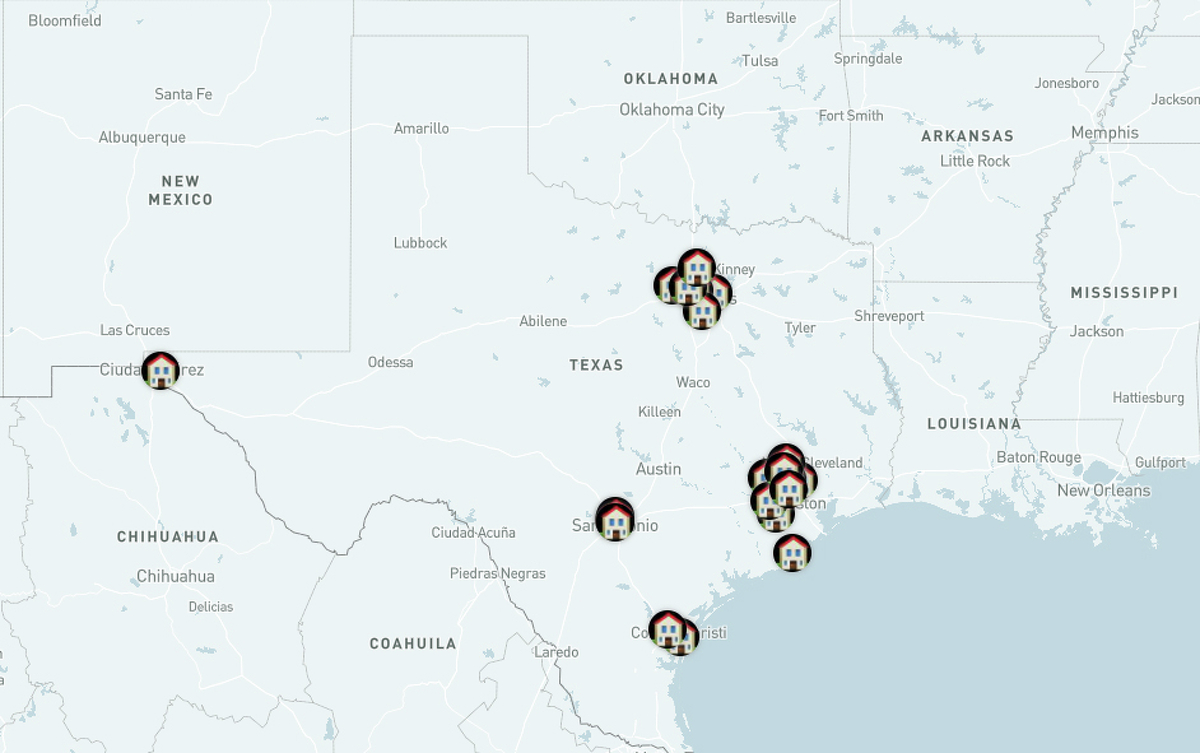

Some Texas Religious Leaders Live In Lavish Tax Free Estates Thanks To Obscure Law

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Here S When Married Filing Separately Makes Sense Tax Experts Say

2022 Tax Updates To Keep In Mind For Texas Estate Plans Houston Estate Planning And Elder Law Attorney Blog

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Tax Talk If You Die In Iowa Is There A State Estate Tax Gordon Fischer Law Firm

Inheritance Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

Inheritance Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

Moved South But Still Taxed Up North

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities